The $ZENKO token.

The token brands buy, so holders can moon-ride the wave

Brands like Google Cloud, HP, Lenovo, Mastercard are already onboard using Zenko to incentivise engagement (with many more to follow).

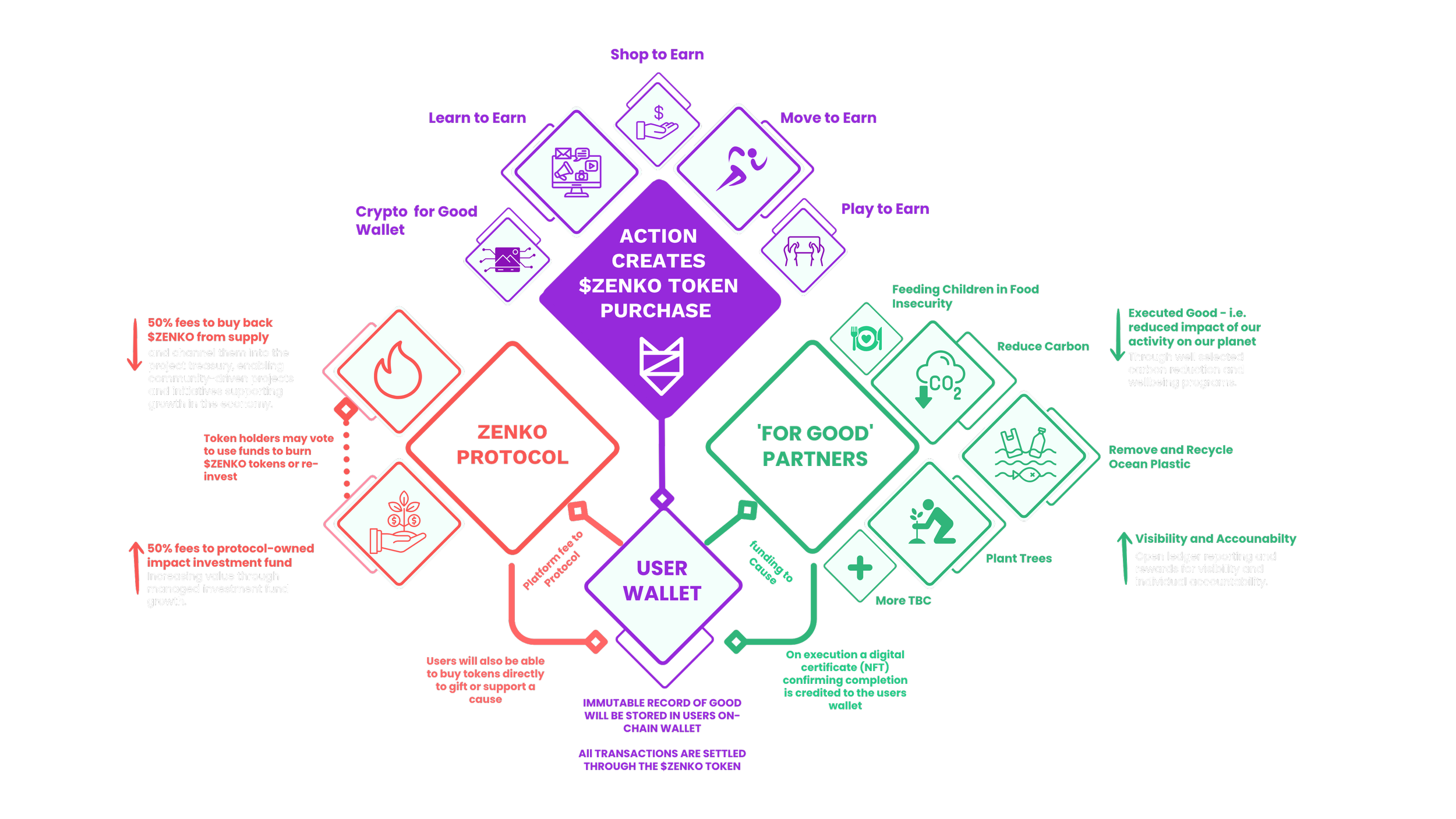

Our smart-contract instantly market-buys $ZENKO with their ad dollars, drops the tokens into user wallets (for brand engagement), and routes 100 % of the fees right back into either 🔥token buy and burns or 🌱eco-investments - it’s your call.

Global utility → relentless buy-pressure → shrinking 1B supply.

Every click, view or mile walked market spikes demand, erases float and leaves an on-chain receipt of real-world good.

Think of $ZENKO as DeENGAGE: a yield machine powered by other people’s ad budgets.

🚀 Multi-dApp demand – Learn-to-Earn, Move-to-Earn, Shop-to-Earn, Play-to-Earn: one token powers every app in the stack.

💸 100 % of fees recycle – 50 % open-market buy-backs, 50 % eco-investments voted by holders.

🌍 Real-world flywheel – brands cut CPL by up to 35 %, do real-world good, while hoovering tokens off the market.

🏆 Top-flight brands sports on deck – Huge global brands and sports clubs onboarding during the summer.

Our Flywheel

Our constant buy-pressure flywheel runs on real-world ad budgets - brands and sports rights holders and more - so $ZENKO demand comes from brands battling for attention, not from crypto trading fees or market cycles.

We make multi-billion dollar advertising and marketing budgets more effective with a self funding good. Reducing cost per engagement by greater than the incentive cost.

It’s this external Web3 money that drives our flywheel, not trading fee’s or airdrops.

Function.

The $ZENKO token standard unit of currency within the protocol and applications, backed by the good, where all transactions on chain are settled through the token and incur a fee.

Giving it a scaling velocity and protocol revenue generation.

100% of all fees generated within the ecosystem are used to support the token and growth.

01.

UNIT OF VALUE

Everything in the Zenko universe (watch-to-earn, move-to-earn, shop-to-earn, dApp fees, NFT mints) settles in $ZENKO.

It’s the conveyor belt that moves value from brands ➜ users ➜ causes.

02.

VALUE-ACCRUAL AND SCARCITY

100% of the protocol fee goes to support the token. 50 % goes to open-market buy-backs, 50 % to the DAO’s fund.

Fewer tokens on the market + an appreciating, revenue-producing treasury = “number go up” pressure.

03.

GOVERNANCE AND TREASURY RIGHTS

Each $ZENKO = 1 vote.

Holders steer investment allocations, approve new causes, and can even vote to burn treasury tokens — true stakeholder control.

5 Year Projection.

Our business model starts conservatively and scales . Our pipeline is already larger than this.

At TGE price we forecast buying over 15 billion tokens in our first five years from the open market.

Token Price Projections

Intro: Why We Handed the Crystal Ball to an AI

When it came to forecasting ZENKO’s price, our team agreed on one thing: humans (especially ones nursing confirmation bias and triple-shot lattes) should not be the sole prophets of token destiny. So we punted the job to something that doesn’t cheer for its own ideas.

Bear Case – Peak $0.10 in March 2026, settling at $0.50 by December 2030.

Slow but reliable utility demand: brands and fan-clubs keep buying ZENKO for campaigns even through a lukewarm crypto cycle.

Base Case – Peak $0.30 in March 2026, hitting $1.00 by December 2030.

Steady mainstream uptake across sports, enterprise ESG programs and schools, with staking locking up a chunk of supply.

Bull Case – Peak $0.75 in March 2026, reaching $3.00 by December 2030.

ZENKO becomes the go-to engagement token for global brands and top-flight clubs; “proof-of-kindness” goes viral and demand rockets.

Tokenomics.

With a launch FDV (fully diluted value) of $10m, 1B supply and a launch token price is 1c.

How the model compounds value

Brands buy attention → tokens bought back.

Every campaign fee splits 50/50: half auto-buys $ZENKO on-market; half flows to the Foundation for impact investments that generate yield back into the DAO.

Non-crypto money powers the flywheel.

Unlike typical Web3 projects that live or die by trading fees, our demand is externally financed—global brands and sports rights holders out-spending each other for fan attention. That means revenue even in a bear.

Deflation + utility = upside.

Buy-backs, burns, staking and real-world good create a shrinking float against rising utility, amplifying price pressure as adoption scales.

Public Sale: Liquid at TGE: - Opens the door for retail users and ensures fair price discovery. A small float keeps FDV low and upside high.

Seed, Private & KOL Round: 3-month cliff, 6-month linear vest. Strategic capital from builders (i.e. Apechain).

Liquidity & Market-Making: Gradual release to CEX/DEX pools. Guarantees deep order books and tight spreads from day one so traders can move size without slippage, underpinning a healthy market.

Community Building (aZENKO): Same vest as Presale; but fully stakeable. Rocket fuel for grassroots adoption: quests, learn-to-earn, referral bounties and governance rewards that turn browsers into “believers with skin in the game.”

Marketing & Growth: Linear over 24 m. Funds influencer pushes, launchpads, sports-club activations and our “for-good” viral loops.

Treasury & Operations Reserve: 8-month lock, 56-month vest. Provides a multi-year runway for protocol R&D, audits and M&A. Fully on-chain, multisig-controlled and community-reporting every quarter.

DAO Foundation & Advisors: 24-month lock, 24-month vest. Funds independent governance, climate-tech investments and expert guidance—zero sell pressure until utility and revenue are proven.

Team: 12-month cliff, 36-month vest. Keeps the builders laser-focused on execution. No fast unlocks, no quick flips—just long-term alignment with holders.