ZENKO Token: 2025-2030 Price Thesis

Intro: Why We Handed the Crystal Ball to an AI

When it came to forecasting ZENKO’s price, our team agreed on one thing: humans (especially ones nursing confirmation bias and triple-shot lattes) should not be the sole prophets of token destiny. So we punted the job to something that doesn’t cheer for its own ideas.

Data buffet: We assembled a smorgasbord of historical price action from utility tokens that actually do something—think Chiliz, BAT, XRP, Helium, even the oddball loyalty-point token that spiked when nobody was looking.

ZENKO DNA: We fed the model every detail of our tokenomics, staking design, flywheel mechanics, and real-world campaigns—warts, reforestation and all.

Training & interrogation: Then we trained an AI model, locked it in an existential vacuum (no hopium, no doom-scrolling), and asked: “Given these cycles, unlock schedules and utility curves, where do you put ZENKO by 2030 under bear, base and bull conditions?”

Results, not wishes: The numbers that follow—$0.50 / $1.00 / $3.00 end-points—are model outputs, not committee compromises. We review them the same way you will: with curiosity, a hint of skepticism, and zero ego invested (but maybe a whole lot of hopium).

Bottom line: the forecast is algorithmic, not aspirational. If we hit the bull track, fantastic; if we hug the bear line, at least we didn’t delude ourselves. Either way, the model’s homework is stapled to this report—so feel free to kick the tyres, tweak the assumptions, or even retrain it with your own data. We won’t take it personally; that was the whole point.

1 | Framework & Methodology

Bitcoin-led macro cycle

Crypto valuations still expand and contract around BTC halvings; next peak expected Q1-2026, with a milder 12-to-15-month draw-down (institutional dampening).

Month-by-month curves are front-loaded into 2025-H1 2026, then interpolate through a shallower 2027 trough before the 2028-30 climb.

Supply mechanics

1 B max supply; 10.5 % unlocked at TGE, linear unlock to 100 % by Jan-2027. Staking APY locks up 20-30 % of float on average.

Early years have a tighter float → bigger %-moves. By 2027 supply is static, so appreciation is driven by utility & demand.

Utility vs. speculation split

Core buyers are brands, sports rights holders & schools who need ZENKO to activate campaigns, not to flip it.

Provides a price floor in bear phases; also justifies why bear can still 5× from TGE (to $0.50) by 2030.

Comparative precedent

• Chiliz: $0.016 → $0.74 in 30 mo (≈46×); fan-token narrative

• BAT: $0.036 → $1.65 (≈45×) at real-utility peak

• XRP: $0.006 → $3.32 (≈550×) in its breakout cycle

Sets upper-bound expectations. Our Bull tops at 300× (0.01 → 3.00) – comfortably inside historic extremes yet ambitious.

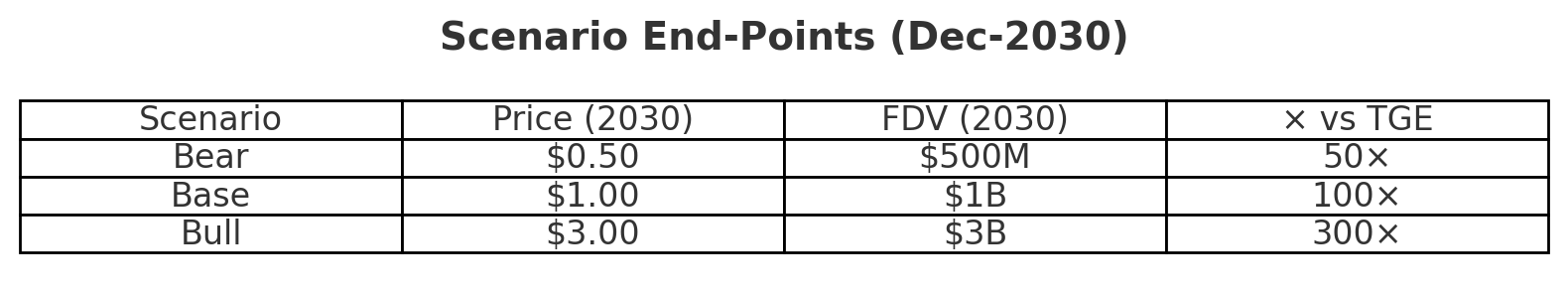

2 | Scenario End-Points (Dec-2030)

Why these caps?

$500 M is ≈½ the size BAT reached with ~50 M browser MAUs – a conservative analogue for a tokenised “engagement” platform.

$1 B has historically been the “mid-cap utility sweet-spot” (BAT, CHZ, ENS, GRT all hovered near that at 2021 peaks).

$3 B equals 2019-era Chainlink or 2024 Helium—aggressive, but not outlandish if ZENKO becomes the cross-brand ESG-engagement rail.

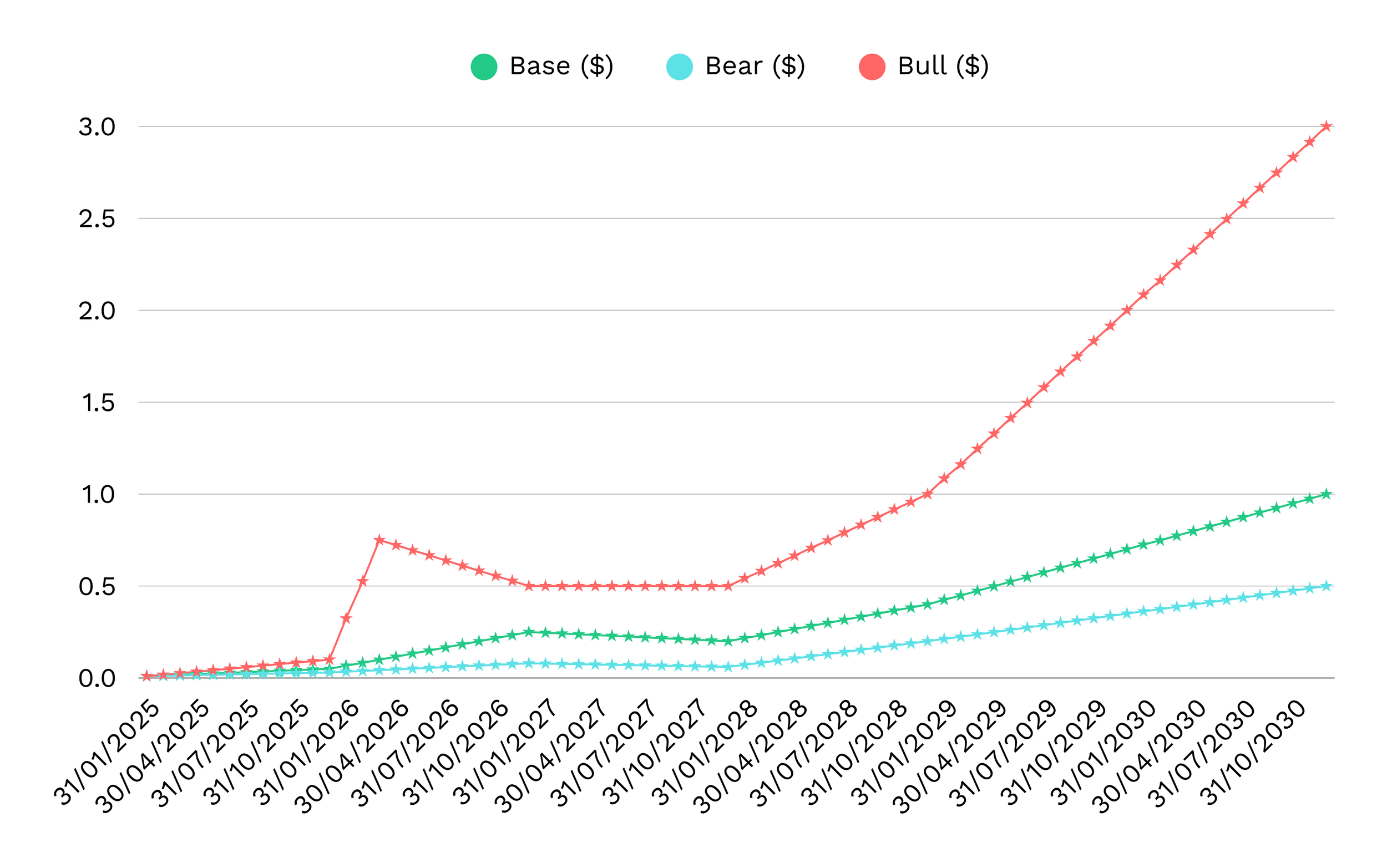

3 | Month-by-Month Trajectories (Jan-2025 → Dec-2030)

Commentary

Dec-2025 - Modest lift as first-year pilots (3 brands, 5 clubs, 10 schools) complete.

Mar-2026 (cycle top) - Mirrors BTC peak; bull spec inflates multiples fastest.

Dec-2026 - Year-end cool-down but staking & buy-backs soften drawdown (max –40 %).

Dec-2027 (trough) - Bear flattens; Base & Bull start catching new enterprise deals (ESG compliance deadlines loom).

Dec-2028 - Second-cycle adoption: brands integrate SDK; sports net-zero mandates bite.

Dec-2029 - Network effects + macro tail-wind ahead of next BTC halving.

Dec-2030 - Full real-world flywheel spinning: millions of wallets, sustained buy-pressure, DAO treasury active.

4 | Why Bear = $0.50?

Intrinsic demand floor: Even in a crypto winter, >50 % of tokens are either staked for APY or locked in long-term brand treasuries to fund recurring campaigns.

ESG budgets are stickier than DeFi yield farming. Marketing departments can’t simply “turn off” fan-engagement spend; they re-allocate it.

Comparable precedents: CHZ bottomed ~12× above ICO price after the 2022 bear, not 90 % down from inception .

Thus a 50 × move over six years (0.01 → 0.50) is the downside scenario.

5 | Why Base = $1?

Adoption curve mirrors BAT (tens of millions of monthly active users, but in a multi-sector setting). BAT’s 2021 FDV ≈$2.5 B ; we haircut to $1 B because ZENKO supplies only 1 B tokens (BAT has 1.5 B+ circulating).

Token velocity balanced by buy-backs: 50 % of protocol fees recycle into market orders, offsetting some sell-side pressure.

Reg-clarity kicker: By 2028-29, UK/EU digital-asset frameworks and MiCA-style regulations allow large household brands to hold small treasury positions, legitimising ZENKO spend.

6 | Why Bull = $3?

Fan-engagement “CHZ × BAT” effect: If both sports franchises and Fortune-500 loyalty programs converge, daily real-world TPS could rival Polygon PoS. A $3 B cap (≈rank-30 today) simply reflects that scale.

Precedent upside cushion: XRP’s 550× cycle move ($0.006 → $3.32) sets the historical ceiling . A 300× run for ZENKO is big but not unprecedented.

Narrative alignment: 2030 climate deadlines + tokenised RWAs go mainstream; “proof-of-kindness” meme could capture retail imagination.

7 | Risk Matrix (and why the curves bend)

8 | Take-aways for Stakeholders

Treasury planning: Even if ZENKO only hits the Bear track, a 5-year compounded return of ~95 % CAGR (0.01 → 0.50) justifies ongoing protocol reinvestment.

Investor framing: Position Bull as optionality; position Base as probable; position Bear as still-handsomely-profitable downside.

Road-map priorities:

Cement at least five tier-1 sports clubs by 2025 Q4 – anchor credibility.

Release no-code brand campaign builder by 2026 Q2 – drives monthly active campaigns into the 100s.

Publish a proof-of-good dashboard for ESG auditors before 2027 – crucial for post-correction regain of momentum.

Final Word: This forecast is algorithmic, not aspirational. Here’s to clearer skies, saner cycles, and a future where “green candles” refer to our mental wellbeing as much as the chart. Remember: the typical ZENKO buyer isn’t a late-night leverage junkie hunting the next 100-X meme— they’re a football fan creating a meal for a child in food poverty in their city with their match-day ticket or a Fortune-500 brand turning ad dollars into tree seedlings. That steady, real-world demand is the tailwind beneath every curve in this report. Onward, and may your wallets be as balanced as your lifestyle.